Torbay tenants in 2023 face further rent hikes, as the number of available rental homes has dropped to an 18 year low. Many ‘accidental’ landlords have cashed in on the post lockdown Torbay property boom of the last two years and sold their properties to Torbay owner-occupiers - not fellow landlords.

- The number of properties available to rent in Torbay has dropped from 619 to 309 since February 2020.

- The average rent a tenant has had to pay in Torbay has risen from £691 to £957 since February 2020.

- Many Torbay landlords have cashed in on the post-lockdown property boom of the last two years and sold their properties to owner-occupiers - not fellow landlords.

- The supply of Torbay rental property isn't near what is needed, which is of benefit to Torbay landlords rather than Torbay renters.

- October has finally seen a shift in rental values starting to reduce to a more normal level

The Torbay rental property shortage is currently still evident although we have experienced a shift back to some normality over the past month or two. In this article, I will investigate why there has been such a significant lack of homes available for rent across Torbay, why this may be starting to shift, and what it means for buy-to-let investors.

Anybody who enjoys surfing the property portals (Rightmove, Zoopla and On the Market) will have observed an emerging trend that the number of properties available to rent in Torbay has dropped considerably in the last couple of years.

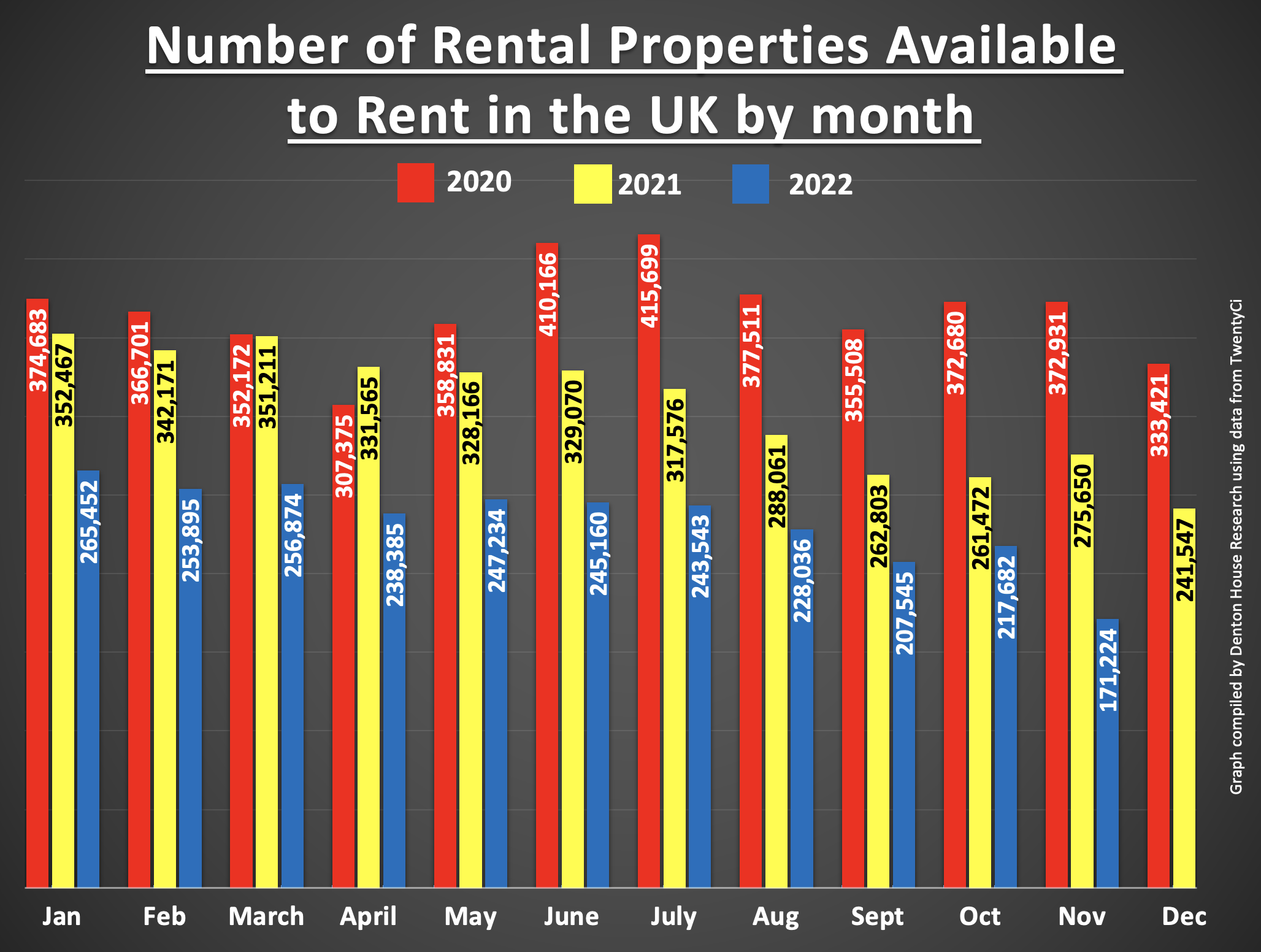

This reduction has been seen all around the UK as well. For example, on 1st November 2020, there were 372,931 properties to rent on portals. By the 1st November 2021, that had dropped to 275,650; by the 1st November 2022, that had fallen to 171,224.

That doesn't mean the number of privately rented homes in the country has dropped by over half. Fewer properties are coming onto the market to rent. I will explain why in this article.

For tenants, especially over the last 12 months, it has become progressively more challenging to find a Torbay rental home, thus making the rent they must pay go up. This state of affairs in the property market isn’t showing an indication of getting any easier either, making it a hard time for Torbay renters.

So, what is the reason behind the Torbay rental property shortage, and what does this mean for existing Torbay landlords or those potential investors considering buying a Torbay buy-to-let property soon?

Several different components are making the perfect storm in the UK property market.

Firstly, the number of households in the UK.

The UK has not been building enough homes for the last 20 years. I appreciate that parts of Torbay seem like one huge building site, yet as a country, we are woefully undersupplied with property to live in. This has meant house prices continue to rise due to demand.

The government have known about this issue for decades. The Barker Review of Housing Supply published in 2004 stated that the UK had experienced a long-term upward trend of 2.4% in real house prices since the mid-1970s because of a lack of house building. The report stated that 240,000 houses needed to be built each year to keep up with demand.

The average number of houses built since the mid-1970s has been around 165,000 per year, meaning the UK is short of 3,375,000 houses

(i.e., 45 years multiplied by 75,000 missing homes per year).

Several years ago, the government set a target to build 300,000 new homes each year to address this issue.

However, in 2019/20, the actual number of homes delivered stood at just 243,770. In 2020/21, the number of properties built dropped to only 216,000 new homes. In a nutshell, there are fewer available homes to buy, meaning fewer available homes to rent.

Secondly, Torbay tenants are staying in their rental homes longer.

A Torbay first-time buyer's average house deposit is £49,592

(the UK average deposit is £53,935).

The average rent of a Torbay property in November 2022 is £957 per calendar month (up from £691 per calendar month in February 2020) – quite a rise!

These numbers translate into Torbay renters not being able to pay the rent and be able to save for a deposit, or if they are saving, it is taking a lot longer to save for a deposit due to the cost-of-living crisis and higher rent costs.

Also, many Torbay tenants have decided to stay in their existing rental homes because of the rent rises. Many landlords are less inclined to raise the rent on an existing property when they have a decent tenant who keeps the property in good condition and pays rent on time. Anecdotal evidence also suggests that rent arrears in those properties are dropping as tenants know if they don’t pay the rent, the chances are they will have trouble finding another property, and if they do, they will have to pay a lot for their next rental home.

For Torbay landlords, this is all positive news - tenants are staying for longer in their Torbay rental properties, arrears are lower, and void periods are less likely. When it comes to the market, there is less competition (because of the decrease in the availability of Torbay rental properties) so this makes the investment an even better bet.

Thirdly, landlords are selling up on the back of recently increased house prices.

It would be difficult for Torbay buy-to-let landlords to ignore the rising property prices in recent years.

The average property value in Torbay in the summer of 2022 was 16.4% higher than in the summer of 2021.

For some Torbay buy-to-let landlords, especially those who were classified as ‘accidental landlords’ (an accidental landlord is a landlord who never chose to become a landlord, it was just after the Credit Crunch of 2008/9, they found themselves unable to sell their property, so they temporarily let their own property out), they chose to ‘cash in’ on the higher house prices. This would have also contributed to the lack of available Torbay homes for rent.

Finally, the post covid trend for holiday makers to stay in the UK rather than travel abroad has seen a boom in holiday rentals especially in our coastal towns. This has therefore meant that landlords who would usually market for long term residential let have been reaping the benefits of higher potential profits from Air BnB due to the increase in demand for this type of rental.

Yet everything isn’t all sweetness and light for Torbay landlords.

Landlords have a few costs to consider before investing in buy-to-let, including everything from regular refurbishment costs, buildings insurance, letting agents’ fees, income tax, and stamp duty.

Talking of costs, one issue some Torbay landlords are facing is their failure to plan financially for the recent mortgage interest rate rises. Some Torbay landlords may have become complacent to the ultra-low Bank of England base rates we have had since 2008 and, therefore, may need to sell their rental property, which, if bought by a first-time buyer, will remove another property from the Private Rented Sector.

Another hurdle to jump is the proposed new regulations requiring better energy efficiency for rental properties. It is proposed all new tenancies must have at least a minimum of a 'C’ rating for their EPC (Energy Performance Certificate) from 2025 (and 2028 for all existing tenancies) although these dates have not been finalised.

Therefore, as a buy-to-let Torbay landlord, it is wise to do your research to make sure the buy-to-let opportunity is correct for your rental portfolio, particularly when it comes to weathering any impending financial storms.

Landlords need to consider the returns from their Torbay buy-to-let investments.

Landlords can earn money from their buy-to-let investments in two ways. One is the property's capital growth, and the other is the rental return (often expressed as a yield). In 96% of buy-to-let investments, there is an inverse relationship between capital growth and yield (i.e., properties that tend to go up in value quicker will have lower yields 96% of the time – and vice versa).

Getting the best balance of yield and capital growth depends on your current and future needs from your Torbay buy-to-let investment.

If you would like me to review your portfolio and ascertain if your existing portfolio will match your current and future needs for the investment - whether you are a client or not, feel free to drop me a line, and we can have a no-obligation chat and possibly organise a review.

What does all this mean for the Torbay rental market?

As aforementioned, whilst year on year there are still significantly fewer rental properties on the market, over the past couple of months we have started to see a shift back to normality with some holiday rentals re-entering the market, some uncertainty over selling seeing homeowners opt for renting over selling. This has meant that properties are taking a little longer to let and we have had to be far more proactive with assessing rents and carrying out rent reductions to ensure that the property is still let in efficient time. It seems that property availability is starting to recover because of the price rises we have seen over the past couple of years. Due to this landlords need to start being more realistic with price to make sure they don’t have long void periods.

Unlike in Scotland, England and Wales do not have rent controls, with Westminster ruling out the possibility of introducing rent control here to deal with the cost-of-living crisis.

You would think rent controls would be a no-brainer, yet economists from around the world have proved for the last 75 years that rent controls might help tenants in the short term, yet ultimately it drives landlords to sell their investments in the long term, thus reducing the stock of available properties to rent out (not great for future tenants).

Therefore, it is highly likely that Torbay rents will continue to rise for tenants over the years but we hope for a more steady stable growth going forward.

Landlords who persevere with their Torbay buy-to-let properties or become a Torbay buy-to-let landlord are set to benefit because they have an asset in very high demand.

In conclusion, the Torbay rental market is a constantly changing picture. What is known is that the supply of rental properties is far from what is needed, which can only be to the benefit of buy-to-let investors rather than of tenants renting.

I see buy-to-let as a long-term investment. Everyone reading this knows that the real value in your buy-to-let investment is playing the long game, allowing your Torbay buy-to-let investment to grow over time. Like the crypto or stock market, getting sucked in by get-rich-quick schemes that are selling 'apparent quick wins' in property investment is very easy.

I regularly highlight the best buy-to-let deals for Torbay landlords with all the estate agents (not just my own). You don't need to be a client of mine either to receive that information. Drop me a line or call (without any cost or obligation) if you are interested in making your first Torbay buy-to-let investment or considering adding to your existing Torbay portfolio.

By

By

Share this with

Email

Facebook

Messenger

Twitter

Pinterest

LinkedIn

Copy this link